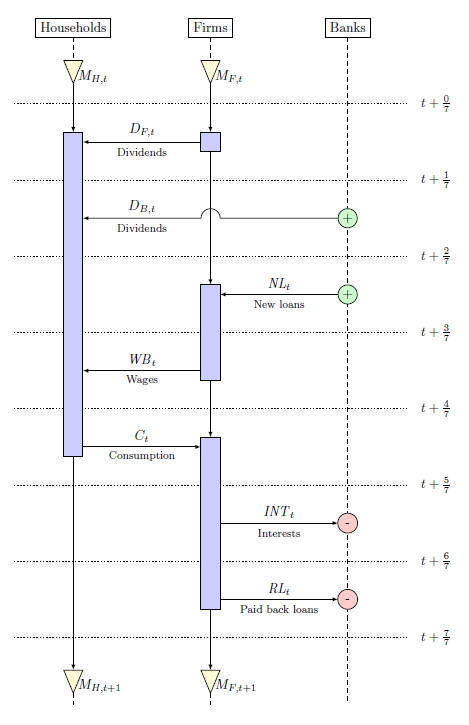

Money flows in an agent-based macroeconomic model with endogenous money

Edit and compile if you like:

% Sequence diagram

% Author: Pascal Seppecher

\documentclass{article}

\usepackage{tikz}

\usepackage[active,tightpage]{preview}

\PreviewEnvironment{tikzpicture}

\setlength\PreviewBorder{5pt}%

\usetikzlibrary{shapes.geometric}

\begin{document}

\pagestyle{empty}

% Agents

\def\Households{Households}

\def\Firms{Firms}

\def\Banks{Banks}

% Money Flows

\def\DF{D_{F,t}} \def \DB {D_{B,t}} \def\Dividends{Dividends}

\def\NL{\mathit{NL}_{t}} \def\NewLoans{New loans}

\def\WB{\mathit{WB}_{t}} \def\Wages{Wages}

\def\SA{C_{t}} \def\Consumption{Consumption}

\def\INT{\mathit{INT}_t} \def\Interests{Interests}

\def\RL{\mathit {RL}_{t}} \def\PaidBackLoans{Paid back loans}

% Diagram

\begin{tikzpicture}[every node/.style={font=\normalsize,

minimum height=0.5cm,minimum width=0.5cm},]

% Matrix

\node [matrix, very thin,column sep=1.3cm,row sep=0.5cm] (matrix) at (0,0) {

& \node(0,0) (\Households) {}; & & \node(0,0) (\Firms) {}; &

& \node(0,0) (\Banks) {}; & \\

& \node(0,0) (\Households 0) {}; & & \node(0,0) (\Firms 0) {}; & & & \\

\node(0,0) (t0 left) {}; & & & & & & \node(0,0) (t0 right) {};\\

& \node(0,0) (\Households 1) {}; & \node(0,0) (\Dividends 1) {};

& \node(0,0) (\Firms 1) {}; & & & \\

\node(0,0) (t1 left) {}; & & & & & & \node(0,0) (t1 right) {};\\

& \node(0,0) (\Households 2) {}; & \node(0,0) (\Dividends 2) {};

& \node(0,0) (\Firms 2) {}; & & \node(0,0) (\Banks 2) {}; & \\

\node(0,0) (t2 left) {}; & & & & & & \node(0,0) (t2 right) {};\\

& & & \node(0,0) (\Firms 3) {}; & \node(0,0) (\NewLoans) {};

& \node(0,0) (\Banks 3) {}; & \\

\node(0,0) (t3 left) {}; & & & & & & \node(0,0) (t3 right) {};\\

& \node(0,0) (\Households 4) {}; & \node(0,0) (\Wages) {};

& \node(0,0) (\Firms 4) {}; & & & \\

\node(0,0) (t4 left) {}; & & & & & & \node(0,0) (t4 right) {};\\

& \node(0,0) (\Households 5) {}; & \node(0,0) (\Consumption) {};

& \node(0,0) (\Firms 5) {}; & & & \\

\node(0,0) (t5 left) {}; & & & & & & \node(0,0) (t5 right) {};\\

& & & \node(0,0) (\Firms 6) {}; & \node(0,0) (\Interests) {};

& \node(0,0) (\Banks 6) {}; & \\

\node(0,0) (t6 left) {}; & & & & & & \node(0,0) (t6 right) {};\\

& & & \node(0,0) (\Firms 7) {}; & \node(0,0) (\PaidBackLoans) {};

& \node(0,0) (\Banks 7) {}; & \\

\node(0,0) (t7 left) {}; & & & & & & \node(0,0) (t7 right) {};\\

& \node(0,0) (\Households 8) {}; & & \node(0,0) (\Firms 8) {}; & & & \\

& \node(0,0) (\Households 9) {}; & & \node(0,0) (\Firms 9) {}; &

& \node(0,0) (\Banks 9) {}; & \\

};

% Agents labels

\fill

(\Households) node[draw,fill=white] {\Households}

(\Firms) node[draw,fill=white] {\Firms}

(\Banks) node[draw,fill=white] {\Banks};

% Horizontal time lines

\draw [dotted]

(t0 left) -- (t0 right) node[right] {$t+\frac{0}{7}$}

(t1 left) -- (t1 right) node[right] {$t+\frac{1}{7}$}

(t2 left) -- (t2 right) node[right] {$t+\frac{2}{7}$}

(t3 left) -- (t3 right) node[right] {$t+\frac{3}{7}$}

(t4 left) -- (t4 right) node[right] {$t+\frac{4}{7}$}

(t5 left) -- (t5 right) node[right] {$t+\frac{5}{7}$}

(t6 left) -- (t6 right) node[right] {$t+\frac{6}{7}$}

(t7 left) -- (t7 right) node[right] {$t+\frac{7}{7}$};

% Available balances at the beginning of the period

\draw

(\Households 0)

node[draw,isosceles triangle,fill=yellow!20, rotate=-90]

(\Households Balance In) {}

node[below right] {$M_{H,t}$}

(\Firms 0)

node[draw,isosceles triangle,fill=yellow!20, rotate=-90]

(\Firms Balance In) {}

node[below right] {$M_{F,t}$};

% Available balances at the end of the period

\draw

(\Households 8)

node[draw,isosceles triangle,fill=yellow!20, rotate=-90]

(\Households Balance Out) {}

node[below right] {$M_{H,t+1}$}

(\Firms 8)

node[draw,isosceles triangle,fill=yellow!20, rotate=-90]

(\Firms Balance Out) {}

node[below right] {$M_{F,t+1}$};

% Vertical lifelines

\draw [dashed]

(\Households) -- (\Households Balance In.west)

(\Households Balance Out.east) -- (\Households 9)

(\Firms) -- (\Firms Balance In.west) (\Firms Balance Out.east) -- (\Firms 9)

(\Banks) -- (\Banks 9);

% Vertical flows (Intertemporal transfers)

\draw [-latex] (\Households Balance In.east) -- (\Households 1);

\draw [-latex] (\Firms Balance In.east) -- (\Firms 1);

\draw [-latex] (\Firms 1) -- (\Firms 3);

\draw [-latex] (\Firms 4) -- (\Firms 5);

\draw [-latex] (\Households 5) -- (\Households Balance Out.west);

\draw [-latex] (\Firms 7) -- (\Firms Balance Out.west);

% Blocks (Budget constraints)

\filldraw[fill=blue!20]

(\Firms 1.north west) rectangle (\Firms 1.south east)

(\Households 1.north west) rectangle (\Households 5.south east)

(\Firms 3.north west) rectangle (\Firms 4.south east)

(\Firms 5.north west) rectangle (\Firms 7.south east);

% Horizontal flows (Monetary interactions)

\draw [-latex] (\Firms 1) -- (\Households 1);

\draw [-latex] (\Banks 2) -- (\Firms 2.east) arc(0:180:0.25cm)

-- (\Households 2);

\draw [-latex] (\Banks 3) -- (\Firms 3);

\draw [-latex] (\Firms 4) -- (\Households 4);

\draw [-latex] (\Households 5) -- (\Firms 5);

\draw [-latex] (\Firms 6) -- (\Banks 6);

\draw [-latex] (\Firms 7) -- (\Banks 7);

% Flows Labels

\fill

(\Dividends 1)

node[above] {$\DF$}

node[font=\footnotesize, below] {\Dividends}

(\Dividends 2)

node[above] {$\DB$}

node[font=\footnotesize, below] {\Dividends}

(\NewLoans)

node[above] {$\NL$}

node[font=\footnotesize, below] {\NewLoans}

(\Wages)

node[above] {$\WB$}

node[font=\footnotesize, below] {\Wages}

(\Consumption)

node[above] {$\SA$}

node[font=\footnotesize, below] {\Consumption}

(\Interests)

node[above] {$\INT$}

node[font=\footnotesize, below] {\Interests}

(\PaidBackLoans)

node[above] {$\RL$}

node[font=\footnotesize, below] {\PaidBackLoans};

% Money creation

\draw

(\Banks 2) node[draw,circle,fill=green!20] {} node {+}

(\Banks 3) node[draw,circle,fill=green!20] {} node {+};

% Money destruction

\draw

(\Banks 6) node[draw,circle,fill=red!20] {-}

(\Banks 7) node[draw,circle,fill=red!20] {-};

\end{tikzpicture}

\end{document}Click to download: sequence-diagram.tex • sequence-diagram.pdf

Open in Overleaf: sequence-diagram.tex